cryptocurrency 2022 taxes

Crypto Taxes Explained For Beginners 2022 Cryptocurrency Taxes. When Youll Owe Taxes on Cryptocurrency.

Defi Crypto Taxes Staying Compliant With The Irs Picnic S Blog

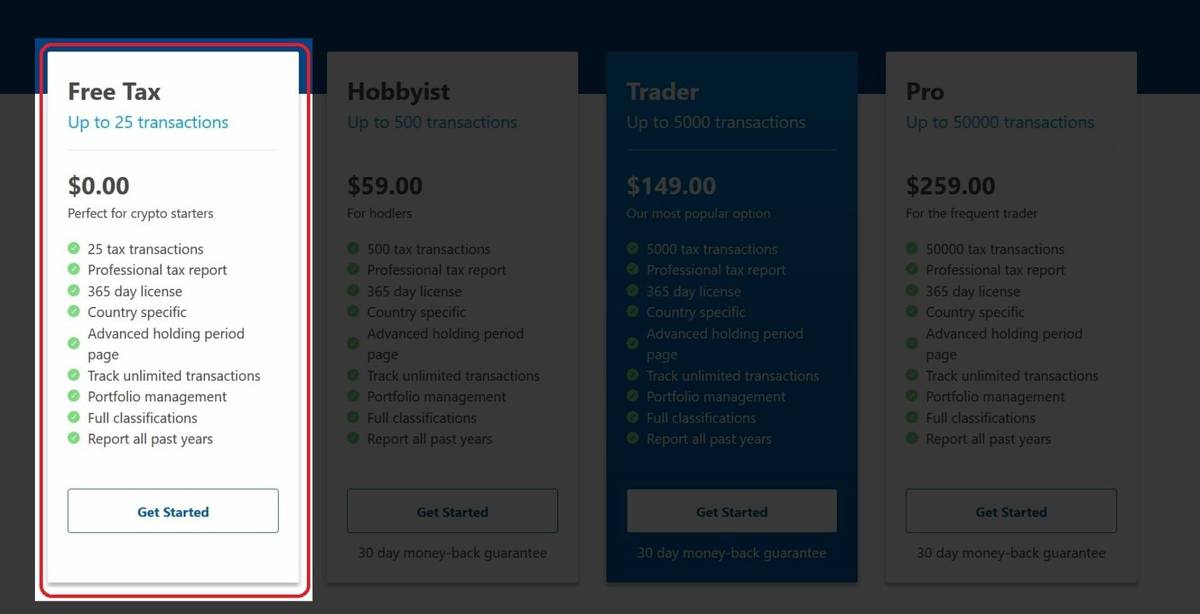

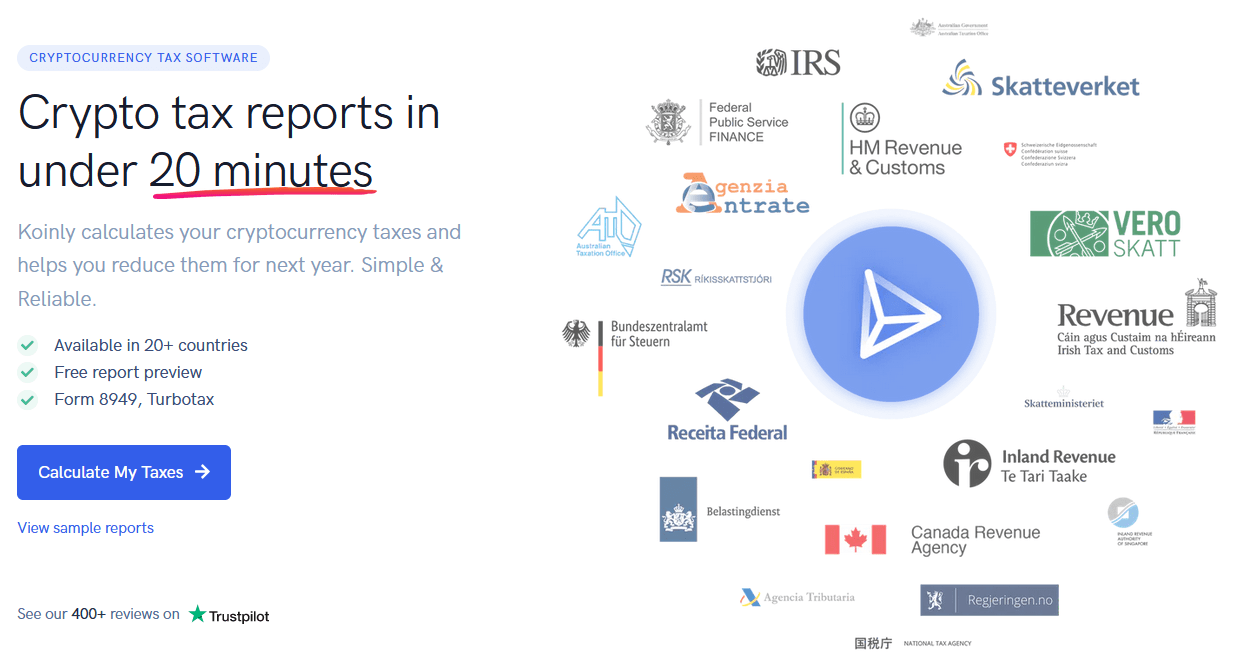

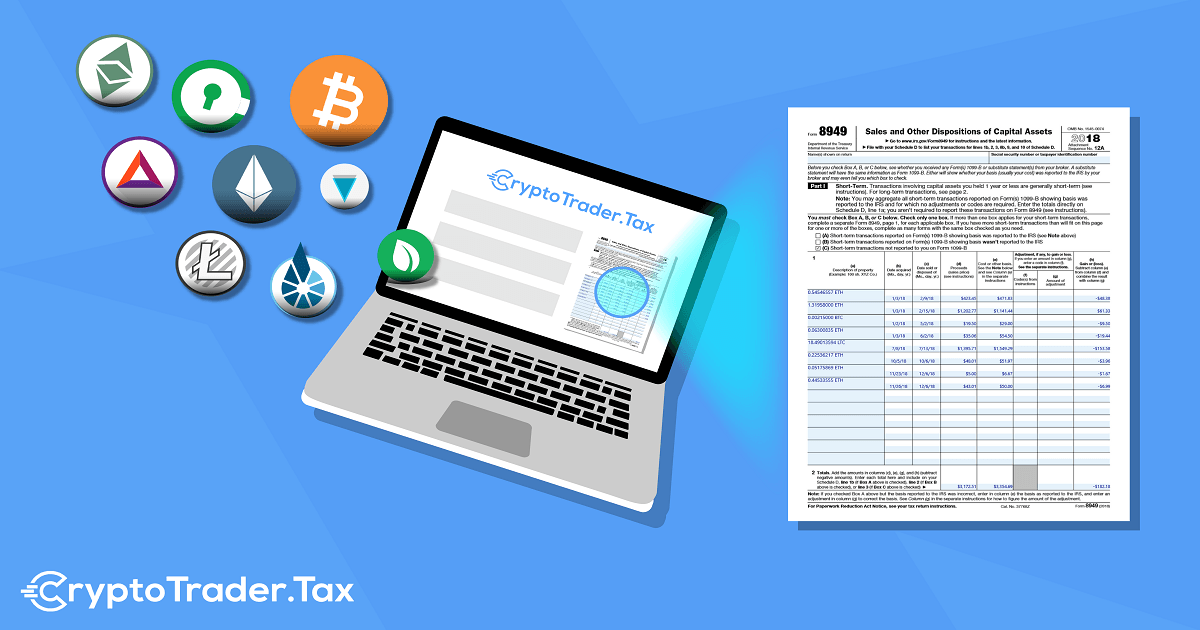

Here are our picks for the best crypto tax tools for 2022.

. But those monthly rates can be. Cryptocurrency also referred to as virtual currency or digital currency is completely digital and does not have a physical form. The main goal of the new proposal is to catch people that are evading taxes with cryptocurrency.

Think cryptocurrency is the next big thing. Its been reported that the House Ways and Means Committee is looking to expand the wash sale rule so that it applies to cryptocurrencies starting in the 2022 tax year. Meanwhile 401 k contributions max out at 19500 for workers under 50 and 26000 for those 50 and older.

Crypto can be declared to the IRS from 1 January 2022 to 15 April 2022. Deadline for tax returns for the previous year 2021. So in 2022.

2 days agoIn 2022 the monthly premium is 17010 for single individuals with up to 91000 in income and married couples with up to 182000. 1 day agoThe tax impact of the infrastructure act. A cryptocurrency tax loophole thats helped investors save thousands of dollars may be closing in the next few months.

The IRS announced this week that 2022s income tax brackets will be higherThey moved it by 62 Joe Bert a Central Florida certified financial planner saidBert noted that 62 is a. The act first passed by the Senate in August was passed by the House on Nov. Narrowing the Cryptocurrency Tax.

Cryptocurrency predictions for 2022. There are some important dates you need to know about. Crypto investors in the USA need to declare their profits losses and income in their Individual Income Tax Return.

While bitcoin and other cryptocurrencies may be virtual they have very real-world tax consequences. You can use this report for filing your taxes. The Infrastructure Investment and Jobs Act signed by the President on Nov.

President Joe Biden signed the landmark infrastructure bill into law concern in the cryptocurrency community is growing around tighter regulations and more onerous declaration requirements for tax purposes. The presidents 2022 budget proposal could lead to a raft of new crypto reporting requirements for those dealing in digital coins. 15 2021 presents a number of issues for taxpayers to consider.

2022 Tax Brackets. The Biden administration has proposed some new tax rule changes that real estate professionals wont want to miss. EC Infosystems a leader in Electronic Data Interchange EDI and BillingCustomer Information Solutions CIS for companies in the deregulated energy industry.

The tax year in Canada runs from the 1st of January 2022 to the 31st of December 2022. Posted on November 7 2021 by coin4world 1 Comment. 5 2021 with an estimated cost of 12 trillion.

Heres how to play it. Canada Tax Deadlines 2021 - 2022. 2022 to begin gathering your reports and figuring out what you owe even if thats how you typically approach tax season.

2021 saw the value of bitcoin triple to an all-time high from about 20000 in 2017 to 66000 in October and it also saw financial institutions step into digital assets aggressively like never before and DeFi decentralized finance became a part Mainly from the cryptocurrency market the global. These programs automatically sync across exchanges and wallets to calculate your gains and losses and give you a final tax report for the year. The bill includes a provision that would make it retroactive to the infrastructure bill.

Bitcoin is the most common form of cryptocurrency. Cryptocurrency predictions for 2022. 2021 saw the value of bitcoin triple to an all-time high from about 20000 in 2017 to 66000 in October and it also saw financial institutions step into digital assets aggressively like never before and DeFi decentralized finance became a part Mainly from the cryptocurrency market the global.

Next year the annual contribution limit for a 401 k will rise by 1000. According to cryptocurrency tax software TaxBit. If you fail to pay the tax you owe you will be subject to.

2022 tax year starts. How to report Capital Gains Tax. The tax deadline was extended to 17 May 2021 in light of COVID-19 with a final extension of 10 October 2021.

How Record-Breaking Inflation Will Affect Your Taxes Julia Glum Nov 11 2021. As of now non-fungible tokens NFTs are not included under the tax. The countrys crypto tax rules that had been previously proposed have been accepted and will go into effect in 2022.

Cryptocurrency is electronic money that is not backed by any government or central bank. Learn what rule changes could affect you in 2022. Although the act includes fewer tax.

President Biden has unveiled his Fiscal Year 2022 Revenue Proposals. South Korean Finance Minister and Deputy Prime Minister Hong Nam-ki said his country is moving ahead with its plan to tax gains on cryptocurrency trading starting in 2022. Luckily there are crypto tax software programs that can help you track this data.

Bitcoin Taxes Overview Of The Rules And How To Report Taxes

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

How The Irs Taxes Cryptocurrency And The Loophole That Can Lower Your Tax Bill

3 Steps To Calculate Binance Taxes 2022 Updated

Crypto Taxation Passes With The House Infrastructure Bill Time To Sort Those Shiba Inu Coin Gains Notebookcheck Net News

Koinly Blog Cryptocurrency Tax News Strategies Tips

5 Best Crypto Tax Software Accounting Calculators 2022

Cryptocurrency Tax Guide 2021 Filing And Paying Taxes On Cryptos Bitira

Cryptocurrency Taxes In The Uk The 2022 Guide Koinly

5 Best Crypto Tax Software Accounting Calculators 2022

.png)

The Beginner S Guide To Crypto Mining And Staking Taxes Cryptotrader Tax

Sold Bitcoin In 2021 It Could Impact Your Tax Bracket The Motley Fool

5 Best Crypto Tax Software Accounting Calculators 2022

Breaking Crypto Assets As Capital Assets Planned From 1 1 2022 Tpa

Cryptocurrency Tax Guides Help Koinly

Irs Sets New Rules On Cryptocurrency Trading

5 Best Crypto Tax Software Accounting Calculators 2022