How much can i borrow on my wage

If you dont know how much your. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability.

This Years Best Homes 1957 Associated Plan Service Free Download Borrow And Streaming Internet Archive Vintage House Plans Floor Plans Ranch How To Plan

9000000 and 15000000.

. Borrowers can typically borrow from 3 to 45 times their annual income. Receive Your Rates Fees And Monthly Payments. Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit.

This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your. This mortgage calculator will show how much you can afford. Your annual income before taxes The mortgage term youll be seeking.

You can use Canstars Home Loan Borrowing Power Calculator to estimate your borrowing power. Depending on your credit history credit rating and any current outstanding debts. How much of your salary can you afford to spend on repayments.

Whilst the typical borrower can expect to be offered between 4 and 45 times their salary its possible to find lenders willing to offer more than that. The first step in buying a house is determining your budget. Your salary will have a big impact on the amount you can borrow for a mortgage.

A combined salary of. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. In certain circumstances you.

Ad Get Offers From Top Lenders Now. The higher mortgage rate has reduced their home buying budget by. Compare Offers Apply.

You have no credit cards or loan commitments and your living expense is 2550 per month. Your monthly recurring debt. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income.

The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. How much you may be eligible to borrow is calculated by multiplying your salary by 4. How much mortgage can you borrow on your salary.

This is based on your income and expenses as well as the home loan interest rate and loan. Get Your Best Interest Rate for Your Mortgage Loan. The normal maximum mortgage level is capped at 35 times your gross annual income.

Best Personal Loans 2022. As a rough rule of thumb you dont want to spend more than 30 of your income on mortgage repayments. This assumes that you dont have any existing debts and a clear credit rating.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Ad Up to 100000 in 24hrs.

The maximum you could borrow from most lenders is around. Ad Our Trusted Reviews Help You Make A More Informed Refi Decision. Ultimately your maximum mortgage eligibility.

Calculate what you can afford and more. Low Fixed Rates from 349 APR. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

The interest rate youre likely to earn. So you have about 4600 spare. Based on your current income details you will be able to borrow between.

Fill in the entry fields. After tax your net income is about 7150 per month. Depending on your lender and your personal situation you can achieve anywhere between two and six times your salary.

For example lets say the borrowers salary is 30k. For example if your gross salary is 80000 the maximum mortgage would be 280000. Compare Quotes Now from Top Lenders.

Suddenly the maximum amount they can borrow on their salary drops to 471000 or 47 times their salary.

Business English Top 100 Most Popular Words In Business English You Should Know Love Eng English Vocabulary Words Good Vocabulary Words Essay Writing Skills

Words Associated With Office Business And Workplace Learn English English Writing Skills English Words

Business English Is An Important Field For Esl Learners Learning Business Vocabulary Can Help You To Improv Advertising Vocabulary Vocabulary Vocabulary Words

The Hourly Income You Need To Afford Rent Around The U S Being A Landlord Income New Things To Learn

Business English Words Anglais English Parleranglais Coursanglais Englishlesson Esl Businessenglish English Vocabulary Vocabulary Words Learn English

Earned Wage Access Adp

Ww7onplf S1ckm

Should I Pay Off My Mortgage Or Student Loans First Home Improvement Loans Mortgage Paying Off Mortgage Faster

Upper Income Adults Without Rainy Day Funds More Likely To Have Access To Money In Case Of Emergency Rainy Day Fund Emergency Borrow Money

![]()

How Much House Can I Afford Interest Com

Pin On Funny

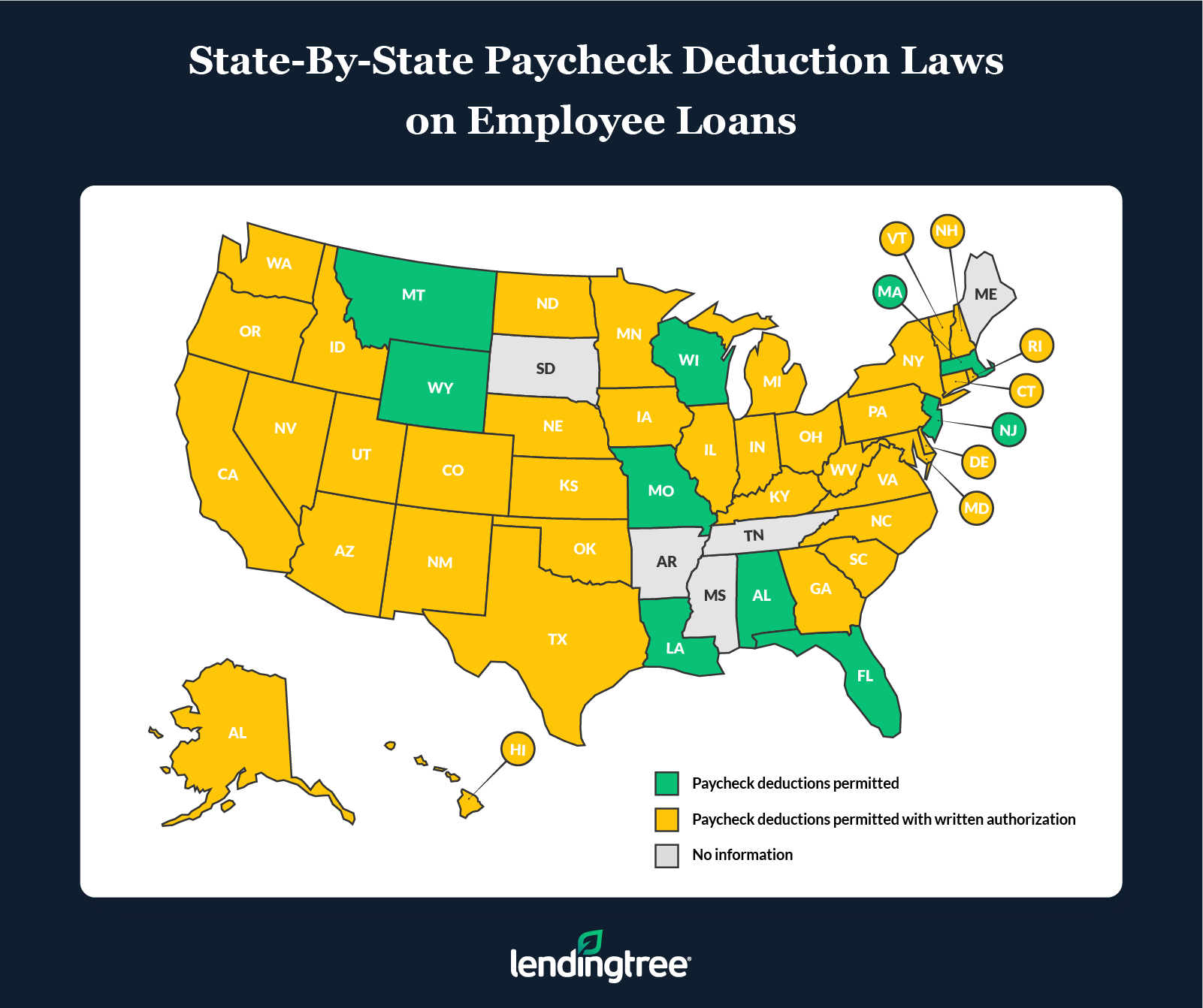

Employee Loans What To Consider First Lendingtree

Stakeholders Seek Fast Track Of New Minimum Wage Minimum Wage Wage Worker

The Shockingly Simple Way To Slash Your Spending Will Give You The Steps To Figure Out How Much Money You Actually Money Management Money Saving Tips Budgeting

Is Your Salary Not Enough You Are Not Alone Many People Are Now Applying For Payday Loans With Quick Loans Express S Paying Bills Payday Loans Personal Loans

:max_bytes(150000):strip_icc()/Clipboard01-f1d6a5bc55844d8a9e488506939e560a.jpg)

What Is Middle Class Income

Pin By Ruby Powell Lenior On Business Emergency Loans Career Success The Borrowers